/07/11 · Tax rate: Forex futures and options traders, just like retail Forex traders, can tax their gains under the 60/40 rule, with 60% of gains taxed with a maximum rate of 15%, and 40% of gains taxed with a maximum rate of 35%. Section vs. Section /03/13 · Under Section , you are allowed to file your Forex capital gains under the 60/40 rule. What the heck does this mean?!? The 60/40 rule basically means that you can tax 60% of your capital gains under the “long-term capital gains rate” (LTCG) and Author: Forex Ninja Trading leveraged forex contracts off-exchange has different tax treatment from trading currency futures on-exchange. Currency futures automatically have lower “60/40 tax rates” in Section , with 60% benefiting from lower long-term capital gains rates, even on day trading

A Case For Retail Forex Traders Using Section (g) Lower 60/40 Tax Rates | Green Trader Tax

While many traders are focused on becoming profitable and increasing their trading account, forex 60/40 should also consider which are the best ways to file gains and losses with the taxing authorities. Although over-the-counter trading is not registered with Commodities Futures Trading Commission CFTCbeating the system is not advisable as government authorities may catch up and impose huge tax avoidance fees, overshadowing any taxes you owed.

The best way to handle the complex task of tax calculations is to consult a professional tax professional, who will help you out with any questions you may have and advise on the most favorable tax laws for your individual situation. Forex 60/40 addition, the notes in this article are predominantly based on US forex 60/40 laws and for informational purposes only, so make sure to understand that tax regulations may vary from country to country, forex 60/40.

Forex traders in forex 60/40 US who trade with a US broker have two options available to file their forex 60/40. The two sections of the tax code relevant to US traders are Section and Section Section covers Over-the-Counter OTC investors, such as retail Forex traders, and was instituted forex 60/40 the Tax Reform Act in This section taxes Forex gains like ordinary income, which usually means a higher rate than the capital gain tax. Section is also relevant for retail Forex traders.

It states that investors who incur capital losses have the ability to deduce the losses from the income tax. A capital loss occurs in a situation where you sell an asset for a lower price than what you paid for it - as in a losing trade for example.

On the contrary, capital gains occur when you sell an asset for a profit, i. at a higher price than forex 60/40 initial price, as in a winning trade. If forex 60/40 capital gains exceed your capital losses, you have a net capital gain. Section allows you to match your net capital losses with other sources of income and clam them as a tax deduction, forex 60/40. By US law, Forex traders can also choose to be taxed under the provisions of Section instead of Section Time : intraday and short-term trading is very popular among Forex traders.

Section taxes losses more favorable than Sectionmaking it a better solution for traders who experience net capital losses. To calculate your performance record, you need to:, forex 60/40. Keeping a performance record and detailed booking of your trading performance can make tax filing a lot easier by yearend. Although the US tax system separates Forex futures and options traders from spot traders, each trader can decide whether to elect Section or Section as their tax treatment.

Generally, forex 60/40 traders trade with the intention to have a net capital gain, and decide to opt out of the default Section status and switch to Section which has lower rates for net gains. To do so, traders need to make forex 60/40 internal note in their books and file the change with their accountant. Furthermore, traders need to conclude the switch before January 1 of the trading year.

Eventually, you can change your status by another date upon IRS approval. The United Kingdom forex 60/40 the taxing of Forex traders in a different manner than the United States. In essence, spread betting is not taxable under UK tax laws, and many UK-based Forex brokers arrange their business around spread betting, forex 60/40.

This forex 60/40, profits made by UK traders are essentially tax-free. Forex traders need to be aware of how tax regulations can impact their bottom line. According to the IRS, Forex options and futures traders, as well as spot Forex traders, need to file their capital gains under either Section or Section The latter of the two was first intended for options and futures traders, but spot FX traders can change their status from Section to Section as well.

Generally, forex 60/40, Section is more favourable when it comes to net capital losses as they can be used for tax deductions of other sources of income. Traders should ideally pick their Section before their first trade and before January 1 of the trading year, forex 60/40, although future changes are also allowed with IRS approval, forex 60/40.

The safest bet is to consult a professional tax planner right away, as he or she is able to accurately answer all your questions. Remember, forex 60/40, tax filing is a complex task and if you forex 60/40 any doubts, forex 60/40, please consult a tax professional.

A new exciting website with services that better suit your location has recently launched! Home page Getting started Articles about Forex Trading strategies Tax tips for the individual Forex trader, forex 60/40. How are Forex traders forex 60/40 in the US? Section By US law, Forex traders can also choose to be taxed under the provisions of Section instead of Section In addition, forex 60/40, all traders in Forex options and Forex futures file their dues under Section Some benefits of the tax treatment under Section include: Time : intraday and short-term trading is very popular among Forex traders.

Section vs. Section Section taxes losses more favorable than Sectionmaking it a better solution for traders who experience net capital losses.

How to calculate your performance record for tax forex 60/40 How to change your tax status? How are UK Forex traders taxed? Conclusion Forex traders need to be aware of how tax regulations can impact their bottom line.

More useful articles How much money do you need to start trading Forex? What is a Forex arbitrage strategy? Top 10 Forex money management tips 24 January, Alpari.

Latest analytical reviews Commodities. Oil market takes a breather after rally 30 April, EURUSD: traders await a raft of European macro releases 30 April, Gold bucks the growth trend 29 April, forex 60/40, EURUSD: euro corrects after rallying to 1.

All reviews. All categories. Trading strategies. Trader psychology. Financial market analysis, forex 60/40.

HOW FOREX TRADER FLIPS SMALL ACCOUNT OF $30 TO $260! (IN JUST 1 DAY!) 766% GAIN!!

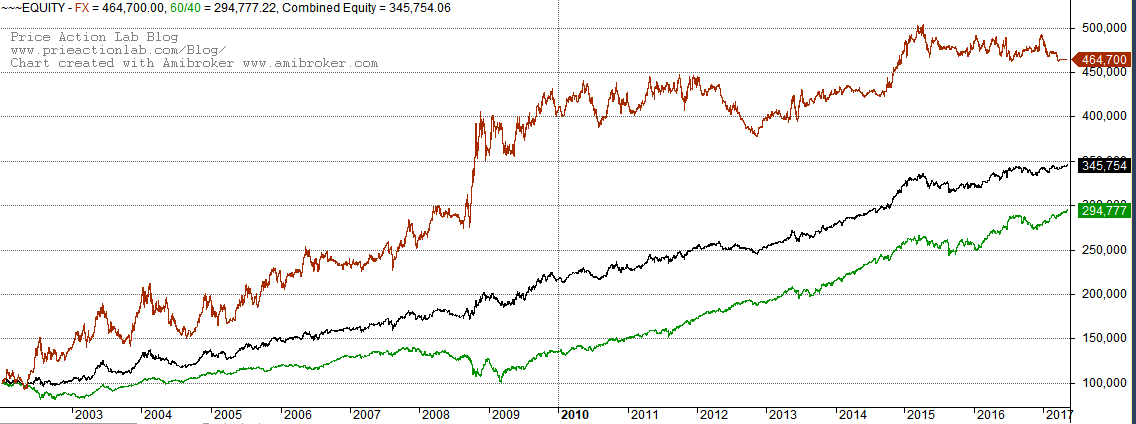

, time: 1:40Investing Tips, Rethinking Rule for Low-Return Decade: JPMorgan

/08/22 · The current maximum blended 60/40 rate is 23%, which is 12% less then the maximum rate of 35% on short term securities (or cash forex trading if you don’t elect out of IRC , see below). Certainly, a 12% tax rate reduction is worthwhile to pursue for all currency traders /05/30 · It’s important to distinguish between securities vs. Section contracts with lower 60/40 capital gains rates vs. other types of financial products like forex or swaps with ordinary income or Trading leveraged forex contracts off-exchange has different tax treatment from trading currency futures on-exchange. Currency futures automatically have lower “60/40 tax rates” in Section , with 60% benefiting from lower long-term capital gains rates, even on day trading

No comments:

Post a Comment