10/09/ · The RSI (Relative Strength Index) is one of the most popular momentum oscillators in trading. A momentum oscillator attempts to document the velocity of an instrument. The RSI is a simple line graph with a reading from 0 to We refer to readings below 30 as an oversold market, and we refer to readings above 70 as an overbought blogger.comted Reading Time: 5 mins Using RSI in Forex Trading - Investopedia 10/12/ · The RSI indicator is a renowned momentum indicator and is one of the most reliable indicators out there. Traders in the stock market and forex alike use it to identify trend reversals and ride the trend to make a huge profit. Here, we will discuss the RSI forex basics as well as a strategy to give you a better understanding of this potent tool

How to Use RSI (Relative Strength Index) in Forex - blogger.com

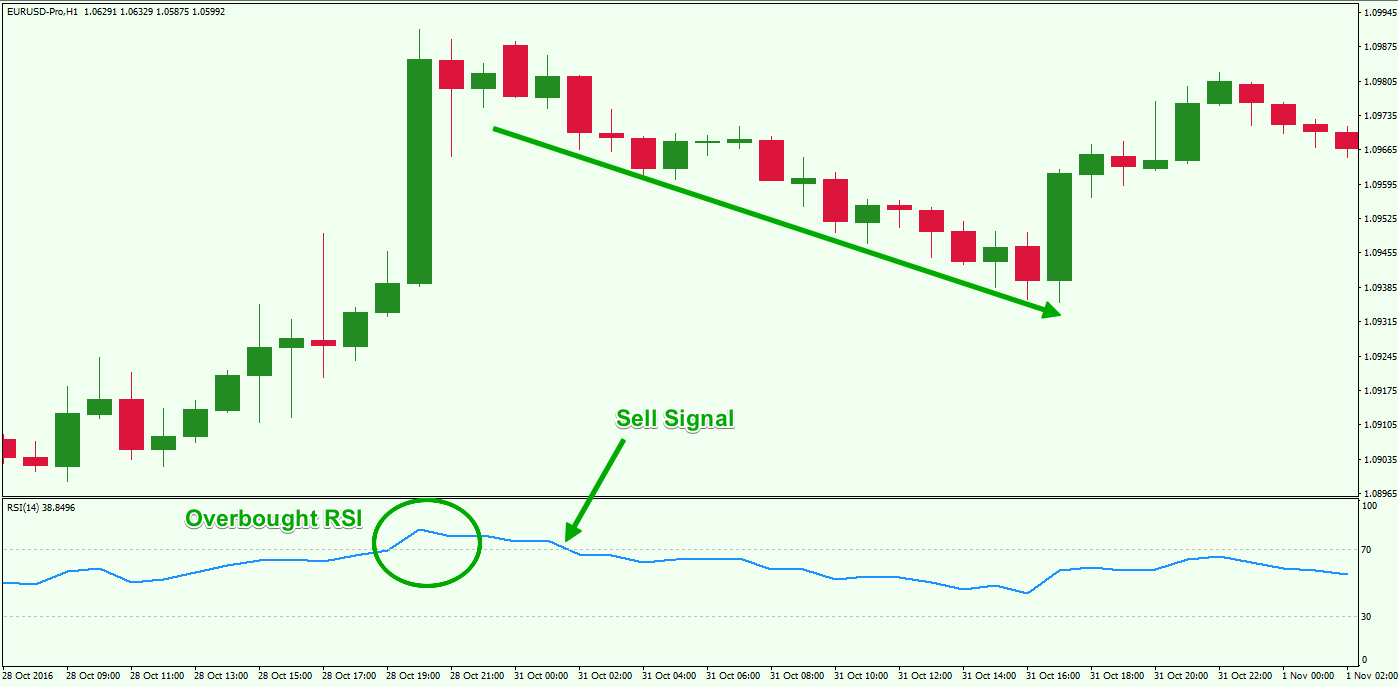

Relative Strength Forex about rsior RSI, forex about rsi, is a popular indicator developed by a technical analyst named J. Welles Wilderthat helps traders evaluate the strength of the current market. RSI is similar to Stochastic in that it identifies overbought and oversold conditions in the market. It is also scaled from 0 to Typically, readings of 30 or lower indicate oversold market conditions and an increase in the possibility of price strengthening going up. Readings of 70 or higher indicate overbought conditions and an increase in the possibility of forex about rsi weakening going down.

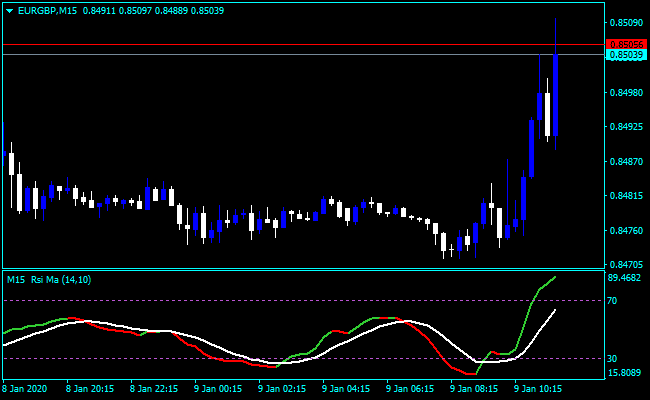

In addition to the overbought and oversold indicators mentioned above, traders who use the Relative Strength Index RSI indicator also look for centerline crossovers. A movement from below the centerline 50 to above indicates a rising trend. A rising centerline crossover occurs when the RSI value crosses ABOVE the 50 line on the scale, moving towards the 70 line.

This indicates the market trend is increasing in strength, and is seen as a bullish signal until the RSI approaches the 70 line. A movement from above the centerline 50 to below indicates a falling trend.

A falling centerline crossover occurs when the RSI value crosses BELOW the 50 line on the scale, moving towards the 30 line, forex about rsi. This indicates the market trend is weakening in strength, and is seen as a bearish signal until the RSI approaches the 30 line. RSI can be used just like the Stochastic indicator, forex about rsi. We can use it to pick potential tops and bottoms depending on whether the market is overbought or oversold.

On June 7, it was already trading below the 1. However, RSI dropped below 30, forex about rsi, signaling that there might be no more sellers left in the market and that the move could be over. RSI is a very popular tool because it can also be used to confirm trend formations.

If you think a trend is forming, take a quick look at the RSI and look at whether it is above or below Sure enough, as RSI passes below 50, it is a good confirmation that a downtrend has actually formed. Partner Center Find a Broker.

RSI Indicator for Forex Beginners (Basics Explained)

, time: 10:14The 2 Most Important Things About The Rsi Indicator: Divergence And Momentum | blogger.com

24/05/ · The relative strength index (RSI) is most commonly used to indicate temporarily overbought or oversold conditions in a market. An intraday forex trading strategy can be devised to take advantage of 10/09/ · The RSI (Relative Strength Index) is one of the most popular momentum oscillators in trading. A momentum oscillator attempts to document the velocity of an instrument. The RSI is a simple line graph with a reading from 0 to We refer to readings below 30 as an oversold market, and we refer to readings above 70 as an overbought blogger.comted Reading Time: 5 mins 10/12/ · The RSI indicator is a renowned momentum indicator and is one of the most reliable indicators out there. Traders in the stock market and forex alike use it to identify trend reversals and ride the trend to make a huge profit. Here, we will discuss the RSI forex basics as well as a strategy to give you a better understanding of this potent tool

No comments:

Post a Comment