Fakeouts basically happen because the forex market is extremely liquid, and while some people will give a lot of weight to certain support and resistance levels, others will not, and hence the market will move in unpredictable ways A “fake out” is also known as failed breakout. Dealing with fakeouts is as important as with a breakout or even more important. This is because fakeouts appear Fakeouts basically happen because the forex market is extremely liquid, and while some people will give a lot of weight to certain support and resistance levels, others will not, and hence the market will move in unpredictable ways. Consequently, you certainly need to use a good money management strategy to protect your balance

How to Detect Fakeouts in Forex - blogger.com

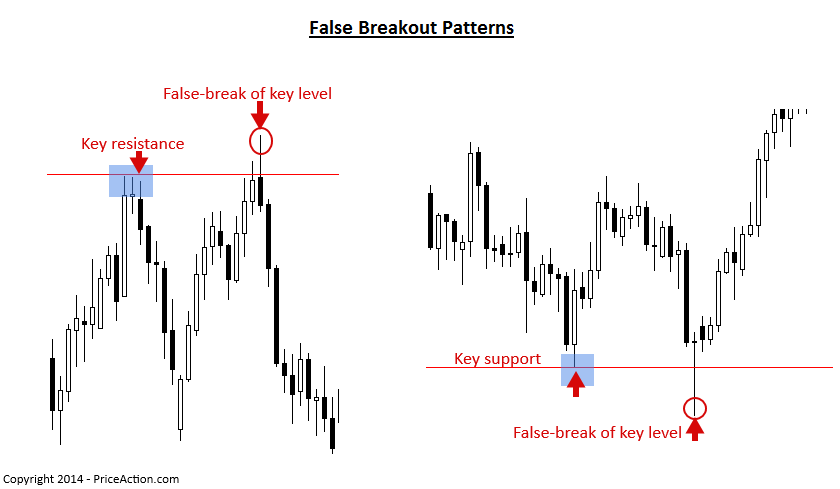

In order to forex fake out breakout s, you need to know where potential fakeouts can occur. Potential fakeouts are usually found at support and resistance levels created through trend lines, chart patternsor previous daily highs or lows. In fading breakouts, always remember that there should be SPACE between the trend line and price.

If there is a gap between the trend line and price, it means the price is heading more in the direction forex fake out the trend and away from the trend line. Like in the example below, having space between the trend line and price allows the price to retrace back towards the trend line, perhaps even breaking it, and provide fading opportunities. If the price is inching like a caterpillar towards the trend linea false breakout may be likely.

However, a fast price movement towards the trend line could prove to be a successful breakout. This will allow you to take the safe route and avoid jumping the gun.

Chart patterns are physical groupings of the price you can actually see with your own eyes. They are an important part of technical analysis and also help you in your decision-making process. The head and shoulders chart pattern is actually one of the hardest patterns for new traders to spot. However, with time and experience, this pattern can become an instrumental part of your trading arsenal.

The head and shoulders pattern is considered a reversal. If formed at the end of an uptrend, it could signal a bearish reversal. Conversely, forex fake out, if it is formed at the end of a downtrendit could signal a bullish reversal, forex fake out. Head and shoulders are known for generating fakeouts false breakouts and creating perfect opportunities for fading breakouts.

False breakouts are common with this pattern because many traders who have noticed this formation usually put their stop loss very near the neckline. Traders who have sold the downside breakout or who have bought the upside breakout will have their stops triggered when prices move against their positions. This usually is caused by the institutional traders who want to scrape money from the hands of individual traders.

You can fade the breakout with a limit order back in the neckline and just put your stop above the high of the fakeout candle. You could place your target a little below the high of the second shoulder or a little above the low of the second shoulder of the inverse pattern. Traders just love these patterns! Why do you ask?

Because of this, plenty of traders place their entry orders very near the neckline in case of a reversal, forex fake out. The problem with these chart patterns is that countless traders know them and place orders at similar positions, forex fake out. Similar to the head and shoulders pattern, you can place your order once the price goes back in to catch the bounce. You can set your stops just beyond the fakeout candle.

The best results tend to occur in a range-bound market. However, you cannot forex fake out market sentimentmajor news events, common sense, and other types of market analysis. Financial markets spend a lot of time bouncing forex fake out and forth between a range of forex fake out and do not deviate much from these highs and lows.

Ranges are bound by a support level and a resistance level, and buyers and sellers continually push prices up and down within those levels.

Fading the breakouts in these r ange-bound environments can prove to be very profitable, forex fake out. However, at some point, one side is eventually going to take over and a new trending stage will form. Partner Center Find a Broker, forex fake out. Next Lesson Summary: Trading Breakouts and Fakeouts. To hell with circumstances; I create opportunities.

Bruce Lee.

How to Avoid False Breakout (My Secret Technique)

, time: 19:08

19/04/ · Partner Center Find a Broker. In order to fade breakout s, you need to know where potential fakeouts can occur. Potential fakeouts are usually found at support and resistance levels created through trend lines, chart patterns, or previous daily highs or blogger.comted Reading Time: 4 mins A “fake out” is also known as failed breakout. Dealing with fakeouts is as important as with a breakout or even more important. This is because fakeouts appear Fakeouts basically happen because the forex market is extremely liquid, and while some people will give a lot of weight to certain support and resistance levels, others will not, and hence the market will move in unpredictable ways

No comments:

Post a Comment