/10/02 · 11 6 Key points to remember – Key Currency Investing Strategies For Beginners. Stop Losses. Always always always use stop losses. Moving stop losses. Take Profits (Targets) The key when it comes to targets is to establish them (as well as stop losses) before you even enter a trade /03/22 · Forex trading strategies: swing trading Swing trading is a medium-term forex trading strategy that seeks to capitalise on larger swings both in-line with and counter-trend. Swing traders are rarely in the market for more than a few days at a time and good swing traders can make serious profits with tight stops and massive reward profiles /03/15 · In particular, this article will guide you through three key Forex trading strategies that beginners can use, namely, the Breakout strategy, the Moving Average Crossover strategy, and the Carry Trade strategy. The Forex market (Foreign Exchange Market or FX) is hugely liquid, with a vast number of participants

Forex Trading for Beginners - Guide for - Admirals

Elite Forex Trading is a website geared to teaching beginners how to learn Forex trading and become profitable from day 1. Go and have fun in the stock market or get into real estate and deal with tenants for the rest of your life. In this post we will be talking about everything you need to started. It will range from starting capital to psychology, mindset, systems, tools, strategies and more. After reading this and our ebook on the right you will have a clear understanding of how to trade profitable.

This post is all about currency trading for beginners. Some of you may already know some of this information, but as we progress through strategies for forex trading for beginners guide you might find new pointers and techniques you had no idea about!

The currency market or Foreign exchange market is one of the most rapidly changing investing markets in the world, with over 5 trillon USD traded everyday!

FX can be highly profitable to individuals and companies that can predict even strategies for forex trading for beginners changes in currency pairs. Banks, governments and even entire countries participate in Forex investing, but you are probably hear as an individual trader looking to earn financial freedom through the markets. But the issue is most new traders rush into the markets without having the correct knowledge.

They fall into this trap and end up losing a lot of money. It is also the most volatile market in the world but does go through periods of consolidation where for weeks at a time to the average individual no price changes will be happening, although on shorter chart periods there will still be movement and volatility these price movements are what professional fx traders profit from.

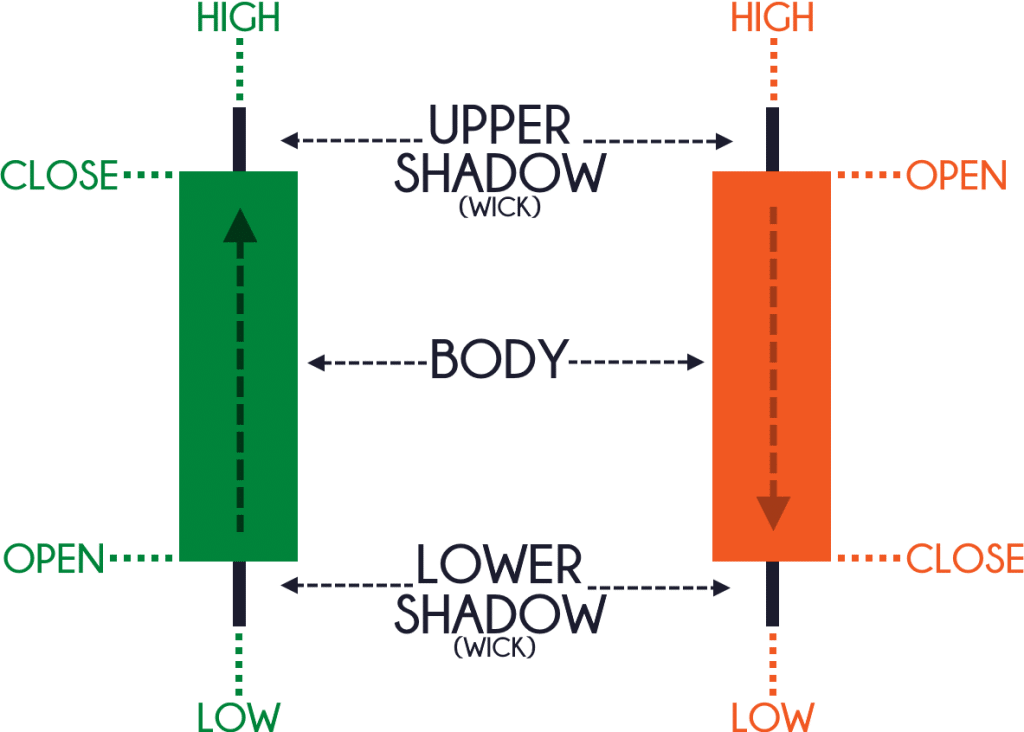

First there are different types of charts and graphs that show the same currency pairs but on different time frames. For example one chart may show the movement on 5 minute intervals.

This means that one entire candle shows 5 minutes worth of data. This is called the 5 minute chart. Below is a screenshot from my account which shows each candle as 4 hours worth of data. Other common examples are the 15 min, strategies for forex trading for beginners, 30 min, 1 hour, 4 hour, 8 hour, 1 day, weekly and monthly charts. Although my personal favourite is the 4 hourlywe will talk about why later in this guide.

Generally the type of trader you are will depend on the chart period that you study the most. The strategy you build will depend on a number of elements:.

As a general rule I like to only look between 15min and the daily with my primary focus on the 4 hour chart. Currencies tend to only change minimally on a daily basis, strategies for forex trading for beginners, but as explained in the what is forex article, with leverage you can create high percentage profits daily, if not hourly, on minimal currency changes.

Currencies or positions when you buy or sell a currency can be held for minutes all the way up to years and the frequency at which you trade is entirely dependent on what you are trying to accomplish both long and short term, strategies for forex trading for beginners, and the strategy you have established. A leverage would allow this individual to trade with half a million dollars worth of funds. If you were going to lose your entire account then leverage helps you achieve your results faster.

The currency markets are extremely stable. Currency prices are based off supply and demand, which cannot be easily manipulated. Even millions invested by banks cannot move prices very much.

As a result the markets can provide both long and short term sources of profits. Before you start investing in the currency markets however, there are a number of basics that you should know, strategies for forex trading for beginners.

As a general rule remember the following: larger corporations banks, countries etc tend to hold currency pairs for longer periods of time as they are moving such large amounts of money strategies for forex trading for beginners of millions and hence are less concerned with smaller fluctuations in the markets. When you first consider starting to trade currencies, especially if you are a complete beginner, strategies for forex trading for beginners, the quotes and graphs and mountains of data can look pretty daunting.

Every currency quote will be valued against another currency, strategies for forex trading for beginners. For example most platforms or brokers will generally display prices similar to below, image source.

There are a number of major currency pairs. These are the larger currencies that are traded against one another. image source. A direct quote is simply where the domestic currency is quoted first. An indirect quote is simply where the domestic currency is the quoted figure. Generally it will be pretty obvious which currency is strategies for forex trading for beginners stronger. For example if you see 1.

Barring any economic meltdowns this will not change. The difference between the bid and ask prices is called the spread. Instead they make their money by the spread on a currency. The spread is measured in points or PIPS. In the above example the 4th decimal point indicates the spread and the difference is 3 pips 52 to Hence the spread is 3 Pips. The pip itself is the smallest measurable fraction by which a currency can move.

Technically there is also another smaller movement called a tick. Spreads can vary for different currencies but most pips tend to be the 4th decimal place of a currency pair. In the major currency pairs the spreads will be tighter, but in less traded currency pairs the spreads will be larger to mitigate the risk of the broker.

All this really means is the following: If you are looking to make a high volume of trades, make sure you stick to the major pairs. Otherwise you will be paying a premium spread on all trades think of it as a tax.

In the opening hour of the day the fx markets are incredibly active and the majority of large trades by big companies, governments, banks, financial corporations are done. This is not the ideal time to invest if you are a newbie to fx trading. The currency market opening times are below image source.

So 24 hours a day for 5 days per week. We just generally recommend being very conscious of when markets open and close, this is because this tends to be when markets and pairs will be the most volatile and as a result move the most in either direction, causing you to either incorrectly analyse the market or just forget and be surprised when you see large movements at specific times. Currency investing is done online instantaneously or close enough anyway.

So its important to have the most efficient tools to allow you to get every advantage on the information and signals or systems you research. There are a strategies for forex trading for beginners more elements I recommend such as leverage, professional training, signals software and back-tested strategies but reading this post and getting our free ebook will give you all the information you need to get started. Surround yourself with like minded successful people and not nay Sayers.

If I had listened to the naysayers I would not be where I am today. We are currently building one at EFT but it is only for advanced traders as of September But watch the space we are looking to build a newbie focused one in the near future!

Now that the baseline information is out of the way its time to get into the real methods, techniques, systems and strategies we use to profit from the market. In the future Elite Forex Trading will be designing our own tools and software to help traders as well as building out a premium community which takes people from 0 to 5 figures a month in earnings, for this though you must have already been through our ebook and First Forex Profits course so please do not apply before this is the case.

When it comes to currency markets there are a couple of methods that when combined lead to highly profitable long term traders. One of the keys to learn, is to understand there are 2 core elements ; fundamentals and technical analysis. Technical analysis is what you here most of the time when you search for beginner forex tips and the like.

These are the techniques that involve Fibonacci, retracement, basic and advanced pattern formations, support and resistance and any kind of mathematical analysis, this is what makes all the difference, the most profitable traders in the world are the ones with the best technical analysis skills.

All our strategies are primarily based on technical analysis with an emphasis on structure, momentum and price action, strategies for forex trading for beginners.

For example, this can be interest rate changes, political announcements, economic indicators, inflation and even things like war or the threat of war for a country.

All these elements have a massive impact on the country and hence have a very large impact on the price of a currency.

These are what cause massive drops and rises in a currency pair. For example the below screenshots show the daily chart when Brexit happened in the UK in When put together, fundamentals and technical analysis can give you a very concrete trading strategy. The strategies for forex trading for beginners you know about the fundamentalsthe easier the technical analysis will become. It involves looking at the forex calendar at forexfactory and then simply saying — Oh will keep an eye on that for 5 minutes….

At EFT we do not trade fundamental trading strategies! Larger financial networks will trade more based on fundamental data as there is a larger impact on their bottom line. Individual traders such as myself and likely you reading this post may look at shorter time frames 15 min — 1 day where fundamentals have less of an impact in our investing strategies. Remember that generally there is not news coming out every hour that will affect a currency, but understanding what certain announcements will do to a currency is essential even if you trade on a low time chart as you do not want to be stopped out on a piece of news that will have no relevance the day after this is called a spike out.

There are hundreds of types of traders. The biggest differences come in the time chart you use for your trading. If you are holding positions for multiple days or weeks at a time, strategies for forex trading for beginners, generally you are called a swing trader. On the other side of the scale you can have a 15min-1hour intraday trader, these are individuals who look to enter in and out of the market inside the same day, usually looking at the 15 minute or 1 hour time charts.

Then there are traders who are in the middle who look to hold positions for anywhere from a few hours to a few days. This is generally called day trading but sometimes gets confused with intra-day trading. Once you become more efficient it will take you less time to analyse the market and hence you may be able to reduce the time frame you trade but for an absolute newbie I would recommend sticking to the higher time frames.

Because it seems more glamorous, faster strategies for forex trading for beginners, in and out etc etc. But I never did. Nowadays I rarely look at the 15 minute chart and the 4HR is my best friend. For example some individuals may only trade counter-trends, meaning they are looking for the point at which a market will turn round.

If a bullish market starts to turn they will look to enter into the market and take out a sell position. These are creatively named trend continuation traders…. Quick note : A bullish market is simply a market where the currency chart is heading upwards, a bearish market is where the currency chart is going downwards.

PERFECT Beginner FOREX Strategy

, time: 23:25Best Beginners Forex Trading Strategies - ( Reviewed ) - SA Shares

/03/22 · Forex trading strategies: swing trading Swing trading is a medium-term forex trading strategy that seeks to capitalise on larger swings both in-line with and counter-trend. Swing traders are rarely in the market for more than a few days at a time and good swing traders can make serious profits with tight stops and massive reward profiles /01/28 · Three simple Forex trading strategies. Below is an explanation of three Forex trading strategies for beginners: Breakout. This long-term strategy uses breaks as trading signals. Markets sometimes swing between support and resistance bands. This is known as consolidation /10/08 · Forex Trading Strategies for Beginners. Forex traders employ different trading styles that mostly fit their own personalities. We can break down Forex market trading strategies into four distinctive trading edges that can be used in different market environments: Forex scalping strategies (Simple Scalping Trading Strategy: The Best Scalping System)

No comments:

Post a Comment