10/01/ · There is simple formula to determine your account’s effective leverage. This formula is printed below: Total Position Size / Account Equity = Effective LeverageEstimated Reading Time: 5 mins 03/11/ · If you want to calculate your leverage automatically, then using a forex leverage calculator is mandatory. You don’t need to pay for it. Leverage calculator allows traders to calculate the total amount of buying power based on the capital or initial investment. However, different leverage calculator will allow you to input different blogger.comted Reading Time: 7 mins 11/01/ · How do I know how much leverage to use? There is a relationship between leverage and its impact on your forex trading account. The greater the amount of effective leverage used, the greater the swings (up and down) in your account equity. The smaller the amount of leverage used, the smaller the swings (up or down) in your account equity

What Is Leverage In Forex? How To Calculate Leverage? - Option Invest

One of the most important elements of forex trading strategies is calculating leverage. At our Forex Coffee Break Education Coursewe probably talk about the leverage formula a little too much, how to determine leverage forex, but certainly not enough.

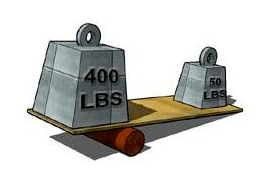

The reason is that the ability to trade on high leverage is one of the key differences between forex trading and other kinds of trading such as stocks. And potentially one of the reasons why many traders lose money trading forex. Leverage is the reason why you can make a ton of money in a short period of time when trading forex. It is ALSO the how to determine leverage forex why you can get screwed over if you make a careless or uneducated decision.

Technically, this is called to 1 leverage, which is much higher than a leverage you can apply when trading stocks. In stock trading, your maximum leverage is only 2 to 1. Leverage is a borrowed money provided by your broker which gives you the ability to control a large amount of money using none or very little of your own money. Here is how to determine leverage forex leverage can do to you and your money:. You give the markets some time to move.

If you fail to analyze all points of the IDDAor simply turn unlucky, the market can move against you: The euro dropps a few pips. If you choose to get out of the market now, this is what will happen:.

If you want to make a thousand dollar trade, you can put in only dollars of your own, and your broker will give you the ability to control the 5 hundred-thousand dollar trade.

As a result, if you make 0. I know that you are now all amazed and excited and probably on your way to add a ridiculous amount of leverage to your trade, but please, how to determine leverage forex, first listen to me carefully when I repeat:. While you can get a significant return, leverage has the potential to bring you equally significant losses. Leverage has another damaging habit too. Using high leverage, you will end up paying more transaction fee to your forex broker.

Leverage amplifies your transaction fee that you have to pay to your forex broker. You thought you can just borrow all this money from your broker and not get charged for it?

They are there to make money and feed their family, and charging for a high leverage is one method for them to make money. The higher your leverage, the higher your transaction cost will be. This cost for sure differs depending on the broker and therefore it is a very important factor to check before choosing a broker. Using leverage shows your risk appetite. And at Invest Diva we advise that your risk per trade should always be a small percentage of your total capital.

A good starting percentage could be 2 percent of your available trading capital. By analyzing the market from all points of the IDDAyou can stack the odds in your favor and then manage your risk per trade. Managing risk per trade, is literally a combination of setting your stop and limit orders, and applying leverage. I thought so. Here is the magic leverage formula in simpler words.

Basically, all you need to know is two items to come up with the best leverage for your forex strategy:, how to determine leverage forex. Then, you can insert your trade size in the final leverage formula to calculate your ideal leverage. All you need to do is dividing your acceptable trade size, by the money you have initially put into your account.

Got a burning trading question you need to be answered? Facebook us, Tweet us, Google us, how to determine leverage forex just come visit us in our office in NYC and ask it in person ��. We definitely want to hear from you, partner with you or just celebrate your progress alongside you! Please click how to determine leverage forex for a detailed break down on our support team com is the online arm of KPHR Capital, LLC based in New York, how to determine leverage forex.

Our mission at Invest Diva is to empower and educate people everywhere to make money on the side by responsible online trading. When addressing financial matters in any of our videos, newsletters or other content, we've taken every effort to ensure we accurately represent our programs and their ability to improve your more お問い合わせ お問い合わせ・ご質問は こちら, how to determine leverage forex.

X How to determine leverage forex Stocks Cryptocurrencies ETF Trading Education Divas. Hit enter to search or ESC to close. 日本語原稿はこちら One of the most important elements of forex trading strategies is calculating leverage. What is Leverage in Forex? I know that you are now all amazed and excited and probably on your way to add a ridiculous amount of leverage to how to determine leverage forex trade, but please, first listen to me carefully when I repeat: Leverage is a Double Edged Sword.

Here it goes: Confused? Basically, all you need to know is two items to come up with the best leverage for your forex strategy: 1- How much you are willing to risk losing in your specific forex trade 2- The distance between your stop loss and entry order Voila! Make Your Money Work For You DISCOVER SECRETS. LATEST UPDATES How to Change Your Life in Ft.

Adam Markel Investing For Women: Why is it Crucially Important The Success Principles- What the Successful Does Differently. Related Posts Cryptocurrencies Uncategorized Investing In Gold — Should You Do It In ? Leave a Reply Cancel Reply My comment is. Who we are InvestDiva. Disclaimer When addressing financial matters in any of our videos, newsletters or other content, we've taken every effort to ensure we accurately represent our programs and their ability to improve your お問い合わせ お問い合わせ・ご質問は こちら オフィス・アワー 月-金曜日: 9時から17時 EST 土曜日: 9時から14時 EST.

Is this legit? You should only invest the money you can afford to lose.

This IS WHY Most BEGINNERS Lose Their ACCOUNTS (What Is Leverage?)

, time: 24:32FOREX: How to Determine Appropriate Effective Leverage

11/01/ · How do I know how much leverage to use? There is a relationship between leverage and its impact on your forex trading account. The greater the amount of effective leverage used, the greater the swings (up and down) in your account equity. The smaller the amount of leverage used, the smaller the swings (up or down) in your account equity 03/11/ · If you want to calculate your leverage automatically, then using a forex leverage calculator is mandatory. You don’t need to pay for it. Leverage calculator allows traders to calculate the total amount of buying power based on the capital or initial investment. However, different leverage calculator will allow you to input different blogger.comted Reading Time: 7 mins 1- How much you are willing to risk losing in your specific forex trade. 2- The distance between your stop loss and entry order. Voila! Then, you can insert your trade size in the final leverage formula to calculate your ideal blogger.comted Reading Time: 5 mins

No comments:

Post a Comment