For using the Volume Profile correctly you have to trade and analyze the future contract of currencies (example 6E for EURO/USD future). By using the Volume Profile with the MetaTrader you will not get the right data of the volume. From our experience, it is useless to trade with the MetaTrader and analyze the volume 09/08/ · What Is Volume Profile? There are two ways of observing the total volume transactions in any market. As a spot forex trader, you can tap into tick volumes as an accurate visual representation of 04/06/ · In this video I go over how to use volume profile in many different ways to give you an edge on the market. I go over some analysis Volume Profile made blogger.com: DejaBrewTrading

How to use the Volume Profile? ++ Strategy & analysis ()

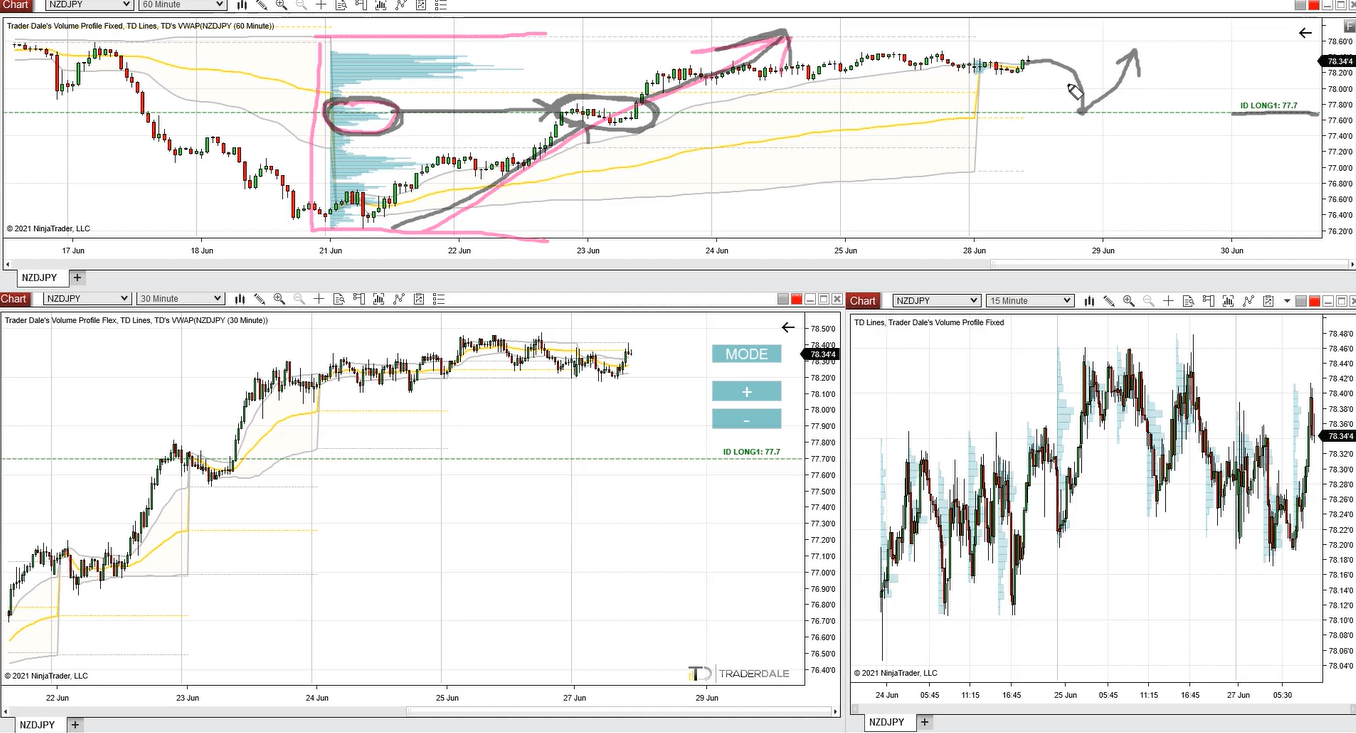

Essentially, Volume Profile takes the total volume traded at a specific price level during the specified time period and divides the total volume into either buy volume or sell volume and then makes that information easily visible to the trader. Depending on a time resolution of a chart, data from various resolutions can be used in calculations of Volume Profile.

When calculating Fixed Range and Visible Rangewe alternately try resolutions from 1, how to use volume profile in forex, 3, 5, 15, 30, 60,1D, until the number of bars in the time interval, for which VP is calculated, will be less than For Session Volume the following dependency on a chart resolution is adopted:.

The first thing that most traders will use volume profile for is identifying basic support and resistance levels. It is important to note that using Volume Profile as an identifier for support and resistance levels is a reactive method. This means that unlike proactive methods such as trend lines and moving averages which are based on current price action and analysis to predict future price movements, reactive methods rely on past price movements and volume behavior.

Reactive methods can be useful in applying meaning or significance to price levels where the market has already visited. Basic technical analysis has shown that a support level is a price level which will support a price on its way down and a resistance level is a price level which will resist price on its way up.

Therefore, one can conclude that a price level near the bottom of the profile which heavily favors the buy side in terms of volume is a good indication of a support level. The opposite is also true. A price level near the top of the profile which heavily favors sell side volume is a good indication of a resistance level. High Volume Nodes HVN are peaks in volume at or around a price level. HVN can be seen as an indicator of a period of consolidation.

Usually there how to use volume profile in forex a great deal of activity on both the buy and sell side and the market stays at that price level for a great deal of time compared to other levels in the profile.

When price approaches a previous HVN or fair value area a sustained period of sideways movement is expected. The market is less likely immediately break through that price. Low Volume Nodes LVN are the opposite. They are valleys or significant drops in volume at or around a price level.

Low Volume Nodes are usually a result of a breakout rally or a breakdown. During a rally or a breakdown, there will typically be an initial burst of volume and then a significant drop off.

When price approaches a previous LVN or unfair value areathe market is much more likely to rally through or bounce off of that price level. Because it is seen as an unfair value area, the market will not spend as much time there compared to some other levels in the profile. Just like with most other tools or studies, Volume Profile has a how to use volume profile in forex of uses. There are many trading strategies out there using Volume Profile as a key component.

Volume Profile is an extremely valuable technical analysis tool that is used by traders everywhere. It is a charting tool that truly does have a wide array of uses, how to use volume profile in forex. The data that is provided by Volume Profile is indisputable, leaving it to the trader to find new and creative ways to use it.

Even though in its simplest form, it is a great reactive method for discovering traditional support and resistance areas, traders are still coming up with ways to chart the indicator in predicative or proactive ways. Consider the trading strategy example given earlier in the article. Number of Rows lets you set a specific number of rows that the indicator will display.

The Ticks Per Row setting establishes how many minimum ticks should be in every row. Toggles the visibility of the Developing Point of Control, showing you how POC was changing when the market was in session.

Toggles the visibility of the Developing Value Area, showing you how VA was changing when the market was in session. Start free trial. Volume Profile Definition Volume Profile is an advanced charting study that displays trading activity over a specified time period at specified price levels.

Typical levels of significance Point of Control POC — The price level for the time period with the highest traded volume. Profile High — The highest reached price level during the specified time period. Profile Low — The lowest reached price level during the specified time period. Value Area How to use volume profile in forex — The range of price levels in which a specified percentage of all volume was traded during the time period.

Value Area High VAH — The highest price level within the value area. Value Area Low VAL — The lowest price level within the value how to use volume profile in forex. Calculation How to Calculate Value Area VA Determine the total volume traded in the profile total buys and sells. Take the number of total buys and sells and multiply it by. Start at the POC The row in the profile with the greatest total volume and record its total volume number.

The POC will be the first profile row added to the Value Area. Now look at the two rows above the POC the initial value area and add the total volume of both. Now look at the two rows beneath the POC the initial value area and add the total volume of both.

Determine which of the total volume numbers is larger and add it to the total volume number of the POC found in step 3. Repeat steps 4 and 5 adding the larger of the two numbers to the Value Area. Once the total volume of your Value Area matches or slightly surpasses the number found in step 2, the Value Area has been determined. The highest row within the Value Area will be your Value Area High VAH and the lowest row within the Value Area will be your Value Area Low VAL.

For Session Volume the following dependency on a chart resolution is adopted: Chart resolution Resolution of bars used for VP calculation 1 - 5 1 6 - 15 5 16 - 30 10 31 - 60 15 61 - 30 - 1D 60 What to look for Support and Resistance Levels The first thing that most traders will use volume profile for is identifying basic support and resistance levels.

Volume Nodes High Volume Nodes HVN are peaks in how to use volume profile in forex at or around a price level. Example strategy Just like with most other tools or studies, Volume Profile has a number of uses. Therefore during the retracement to the Point of Control, how to use volume profile in forex, there is a buying opportunity.

Therefore during the retracement to the Point of Control, how to use volume profile in forex, there is a selling opportunity. Summary Volume Profile is an extremely valuable technical analysis tool that is used by traders everywhere. Launch Chart.

Volume Profile Trading Examples - How Do You Use Volume Profiles?

, time: 20:47Volume Profile — TradingView

04/06/ · In this video I go over how to use volume profile in many different ways to give you an edge on the market. I go over some analysis Volume Profile made blogger.com: DejaBrewTrading For using the Volume Profile correctly you have to trade and analyze the future contract of currencies (example 6E for EURO/USD future). By using the Volume Profile with the MetaTrader you will not get the right data of the volume. From our experience, it is useless to trade with the MetaTrader and analyze the volume 09/08/ · What Is Volume Profile? There are two ways of observing the total volume transactions in any market. As a spot forex trader, you can tap into tick volumes as an accurate visual representation of

No comments:

Post a Comment