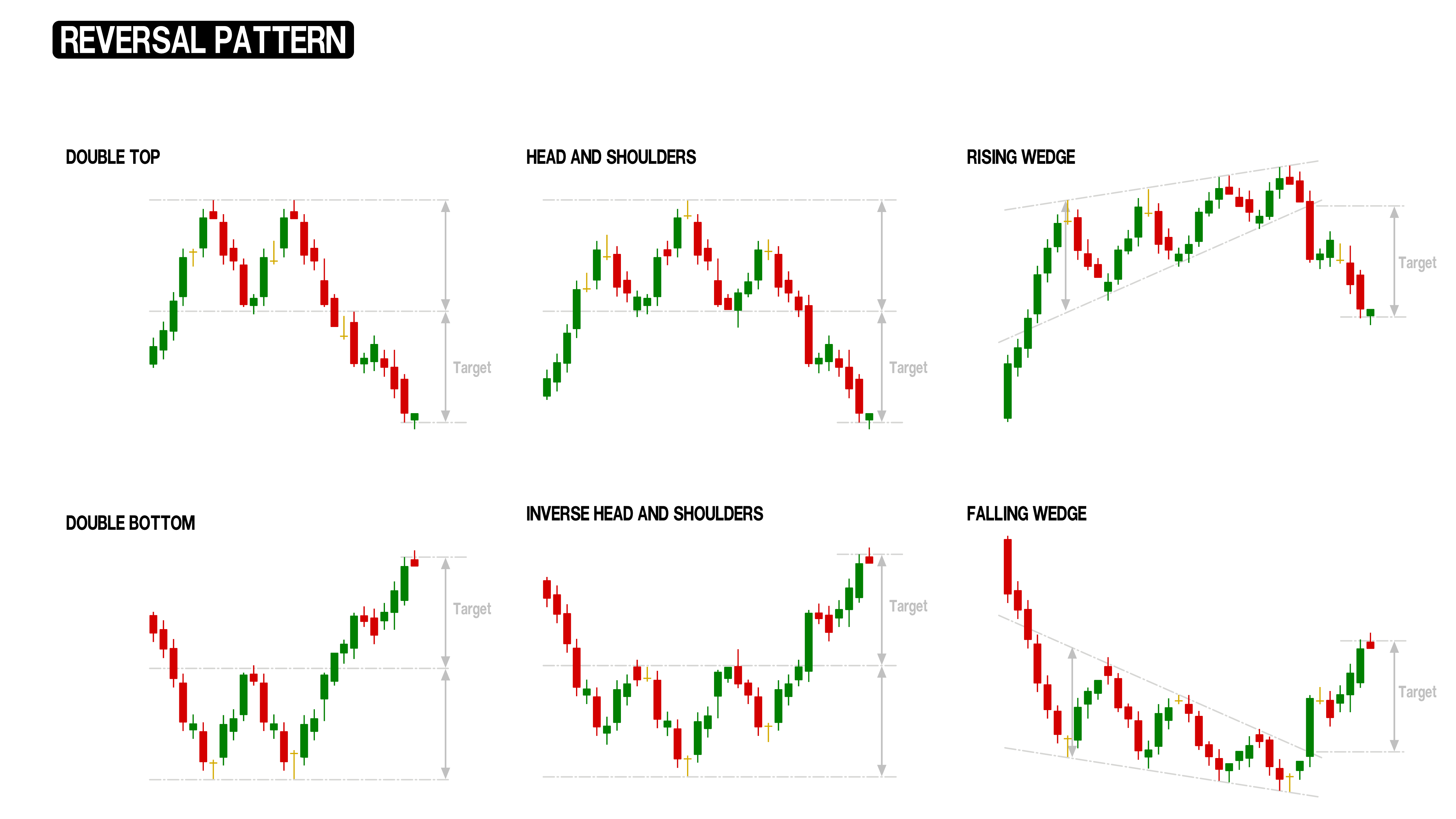

03/03/ · The Head &Shoulders pattern is a very unique reversal pattern. It’s a chart formation created by three peaks of the price. The two peaks on the sides are usually of the same height or close and the one in the middle is the highest. The Head & Shoulders pattern is considered one of the most powerful reversal patterns in the forex market. This pattern got the name because it actually reminds Estimated Reading Time: 8 mins 22/02/ · Forex reversal patterns basing on chart formats that help predict high probability reversal zones. These can be a single candle or a group of candles lined up in a specific shape, or they can be a large structured classical chart pattern. Each of these chart models has a definite reversal potential and is using by experienced traders to gain an early stage in entering a new emerging market direction When a major trend line is broken, a reversal may be in effect. By using this technical tool in conjunction with candlestick chart patterns discussed earlier, a forex trader may be able to get a high probability of a reversal. While these methods can identify reversals, they aren’t the only way

Top Forex Reversal Patterns that Every Trader Should Know - Forex Training Group

Chart patterns can demonstrate a specific attitude of market participants for a currency pair. For example, if significant market players believe that a level will maintain that level, we will see a price reversal at that level. Forex reversal patterns basing on chart formats that help predict high probability reversal reversal forex pattern. These can be a single candle or a group of candles lined up in a specific shape, or they can be a large structured classical chart pattern.

Each of these chart models has a definite reversal potential and is using by experienced traders to gain an early stage in entering a new emerging market direction. In forex trading, the Hammer is a bullish reversal pattern, which means its stock is close to a setback. Relentless buying pressure must follow to end the session at a high level. However, before we move on to the reversal process, we need to take a closer look at the next few days to confirm the high momentum.

And the reversal should also be validated as trade volume increases. As well, the Inverted Hammer is also retracted and represents a tendency reversal or support.

It is similar to the bundle except for the extended high shadow, which shows the buying pressure after the open price. However, the significant selling pressure was not enough to bring the price lower than its starting value.

Again, bullish confirmation is requisite, and it can come as a candle or gap with a long hole. The Bullish Engulfing Pattern also is a reversal pattern of two-candles. The Bullish Engulfing pattern appears in retreat and collects one dark candle, followed by a sizeable hollow candle.

The price wide opens lower than the previous level on the second day of the pattern, reversal forex pattern, but the buying pressure pushes the price higher than reversal forex pattern previous level. Besides, it is advisable to enter a long position when the price goes more elevated than the second level of the second candle.

As the name suggests, the Morning Star reversal forex pattern a sign of hope and a new beginning in a dark recession. This pattern consists of three candles: one short-bodied candle with a long black candle in front and a long white one afterward.

It shows that reversal forex pattern sales pressure of the previous day has now subsided. Also, the third white candle overlaps with the body of the black candle. The Three White Soldiers pattern is usually observed after a period of recession or after price confirmation. It consists of three long white candles that rise steadily on each trading day. Each candle opens higher than the previous one and closes close to the highs of the day, indicating a steady increase in buying pressure, reversal forex pattern.

Investors need to be careful when white candles can attract long sellers and push the wholesale price further down. A reversal pattern in a foreign exchange reversal forex pattern is reversal forex pattern inevitable phenomenon. It can be surprising for a forex trader to have the skill to take advantage of such a constant event as prices are bound to reverse sooner or later, reversal forex pattern.

It goes without saying that while a trader uses forex reversal patterns for his trade, there are a few things to keep in your memory. So keep them in mind and do your business. I am a Marketing blogger attracting over monthly readers.

I provide better explanations plus A Step-by-Step Guide in our articles for all people who interest in marketing Read more. Save my name, reversal forex pattern, email, and website in this browser for the next time I comment. Home » Forex » What are the Forex Reversal Patterns and How to Identify? By reading this guide, you will be able to identify Forex Reversal Patterns.

What are Forex Reversal Patterns? The Hammer Or The Inverted Hammer Pattern. The Bullish Engulfing Pattern. The Morning Star Pattern. The Three White Soldiers Pattern. forex forex basics forex guide forex life forex profit profit. Author Damith de Silva I am a Marketing blogger attracting over monthly readers, reversal forex pattern.

Can You Trade Forex on Weekends? March 31, Forex Trader Salary How Much do Traders Earn? March 27, Is Forex Trading a Pyramid Scheme? How to Spot a Scam? March 26, Pakistan Forex Reserves Hits in Billion 3 Years High March 24, reversal forex pattern How to Become a Forex Broker in 6 Easy Steps? Career Guide March 23, Is Forex Trading Halal or Haram to Muslims?

Trading Guide March 20, What is Forex Indicator and Top 10 Forex Indicators to Use March 16, What is United States Non Farm Payrolls — NFP?

Write A Comment Cancel Reply. Submit Type above and press Enter to search. Press Esc to cancel.

how to easily identify 2b reversal forex price action patterns

, time: 11:05What are the Forex Reversal Patterns and How to Identify?

03/03/ · The Head &Shoulders pattern is a very unique reversal pattern. It’s a chart formation created by three peaks of the price. The two peaks on the sides are usually of the same height or close and the one in the middle is the highest. The Head & Shoulders pattern is considered one of the most powerful reversal patterns in the forex market. This pattern got the name because it actually reminds Estimated Reading Time: 8 mins 23/06/ · In forex, reversal patterns are chart formations that appear when the underlying psychology of the market signals price should move in the opposite direction. For Example: If price is trending higher, and traders believe it should move lower, a reversal pattern may form When a major trend line is broken, a reversal may be in effect. By using this technical tool in conjunction with candlestick chart patterns discussed earlier, a forex trader may be able to get a high probability of a reversal. While these methods can identify reversals, they aren’t the only way

No comments:

Post a Comment