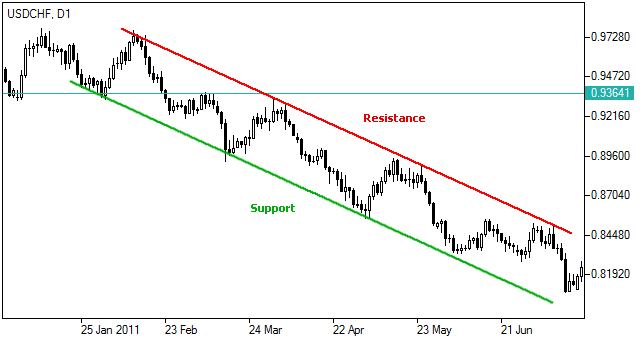

Let’s get started in the nearest webinar session with discount- DISCOUNT CODE: ACADEMIA Page 5 FOREX TRADING COMPLETE COURSE STUDY The Forex market is the largest financial market in the world The Forex market is open 24 hours a day, 5 ½ days a week Currencies are always traded in pairs You can buy and you can sell currency pairs Advantages of Trading the Forex Market There are many benefits and advantages of trading blogger.comted Reading Time: 17 mins 29/04/ · Live London Forex Trading Session, The money making channel. How to Open a TD Ameritrade Account (Step by Step for Beginners) $30 Welcome Bonus RoboForex, Profit is fully Withdrawable 30/04/ · Channel trading can be a great way to find support and resistance areas and potential breakout trades. When channel trading, we are trading a channel as it forms and bounces or breaks through the previous channels levels. In this post, we discuss exactly what channel trading is and the best strategies to use it. NOTE: You can get your free channel trading strategies PDF blogger.comted Reading Time: 4 mins

Channel Trading Strategies Quick Guide With PDF

Our Forex trading PDF, it is widely believed that forex is one of the biggest and most fluid or liquid asset markets in the world. Sometimes referred to as FX, trading channels forex pdf, currencies are traded 24 hours per day — 7 days per week.

In simple terms, refers to the process of exchanging one currency to another — and generally speaking, this will be for tourism, commerce, trading and many other reasons.

In this forex trading PDF we trading channels forex pdf going to talk about what forex trading is and some of the commonly used terminology in the industry. Essentially, it is the action of selling or buying foreign trading channels forex pdf. Of course, these are all used by banks, corporations and investors for a variety of reasons like profit, making a trade, exchanging foreign currencies and tourism.

One of the major benefits with forex trading is that after opening a position, traders are able to put in place an automatic stop loss as well as at profit levels this closes the trade. The forex market is a place to buy or sell against each other a variety of national currencies, globally.

Wherever two foreign currencies are being traded, you can be sure that a forex market exists regardless of the timezone. In this section of our forex trading PDF, we are going to run through some of the most commonly used forex trading terminologies in the industry. The pip represents the smallest amount possible a currency quote can alter. For instance, 0. The differentiation between the sale price and the purchase price of a currency pair is trading channels forex pdf as the spread.

The least popular least commonly used currency pairs usually have a low spread. In some cases, this can be even less than a pip. When trading the most commonly used currency pairs the spread is often at its lowest. The total value of the currency pair needs to surpass the spread in order for the forex trade to become profitable. In order for forex brokers to increase the number of trades available to its customers, they need to provide capital in the way of leverage. Before you can trading channels forex pdf using leverage, you must sign up to a forex broker and open a margin account.

Contingent on the broker and the size of the position, leverage is usually capped at if you are a retail client non-professional trader. Some offshore forex brokers will offer much more than this if you are seeking higher limits. It is because of the aforementioned example that you should exercise caution when using leverage.

Should the worst possible scenario happen and your account falls below 0, you should contact your forex broker and ask for its policy on negative balance protection.

The good news is that all forex brokers which are regulated by ESMA the European Securities and Markets Authority will be able to provide you with this extra level of protection, ensuring that you never become in debt with your broker.

Margins are a good way for traders to build up their exposure. Put simply, in order for a trader to maintain position and place a trade, the trader needs to put forward a specific amount of money first — this is the margin. Rather than being a transaction cost, trading channels forex pdf, the margin can be compared to a security deposit, trading channels forex pdf.

This will be held by the broker during an open forex trade. It is commonplace for forex brokers to give their customers access to leverage see above.

In order for you to lower your risk of exposure and offset your balance, you might consider hedging, trading channels forex pdf. This is a procedure which involves traders selling and buying financial instruments.

When there are movements in currencies, a hedging strategy can reduce the risk of disadvantageous price shifts. The protection of this technique is often a short term solution. Traders often turn to hedge in a panic as a result of the financial media reporting volatility in currency markets. This is usually down to huge events like geopolitical turmoil conflict in the middle eastglobal health crisis COVID and of course the great financial crisis of To counteract negative price movements, market players will tactically take advantage of attainable financial instruments in the market.

This is hedging against risk in its truest form. Hedging will give you some flexibility when it comes to enhancing your forex trading experience, but there are still no guarantees that you will be totally protected from any losses or risks, trading channels forex pdf. While it can take some time to get your head around heading in the forex markets, the overarching concept is that it presents both outcomes.

That is to say, irrespective of which way the markets move, you will remain at the break-even point less some trading commissions. More specifically, the spot trade is a spot transaction, with reference to the sale or the purchase of a currency. Essentially, spot forex is to both sell and buy foreign currencies. A good example of this is if you were to purchase a certain amount of South African rands ZARand exchange that for US dollars USD. If the value of the ZAR increases, you are able to exchange your USD back to ZAR, meaning you get more money back in comparison to the trading channels forex pdf you originally paid.

CFD is basically a contract which portrays the price movement of financial instruments. So, without having to own the asset, you can still make the most of price movements, whilst also avoiding the need to sell or buy vast amounts of currency. CFDs are also accessible in bonds, commodities, cryptocurrencies, stocks, indices and of course — forex. With a CFD you are able to trade in price movements, cutting out the need to buy them at all.

This section of our forex trading PDF is all about forex charts. When it comes to a MetaTrader platform, traders can use bar charts, line charts and candlestick charts. You can usually toggle between the different charts, depending on your preferences, fairly easily. The first record of the now-famous candlestick chart was used in Trading channels forex pdf during the s and proved invaluable for rice traders.

These days, this price chart is without a doubt one the most popular amongst traders all over the world.

Much like the OHLC bar chart see belowcandlestick charts provide low, high, open and close values for a predetermined time frame. Live forex traders love this chart due to its visual appearance and the range of price action patterns utilised. This allows you to gain a better understanding of how live trading works before you take any big financial risks in the market. As the title suggests, this one is a bar chart, and each time frame a trader is looking at will be displayed as a bar.

In other words, if you are viewing a daily chart you will see that every bar equates to a full trading day, trading channels forex pdf. With this price chart, traders are able to establish who is controlling the market, whether it be sellers or buyers. OHLC analysis was the starting block for the creation of the ever-popular candlestick charts please further down.

It is a great tool for looking at the bigger picture trading channels forex pdf it comes to trends. The line chart arranges the close prices at the end of that time frame; so in this case, at the end of the day, the line will connect the closing price of that day. In this section of our forex trading PDF, we are going to talk about the different ways in which you can sell and buy a forex position as well as things to look out for. When it comes to forex trading you can trade both short and long, but always make sure you have a good understanding of forex trading before embarking on trades.

After all, forex trading can be a bit complex to begin with, especially when mixing long and short trades. In a nutshell, going long is usually a term used for buying. So, when traders expect the price of an asset to rise, they will go long. When forex traders expect the price of an trading channels forex pdf to fall, they will go short.

This means benefiting from buying at a lesser value. To achieve this, you simply need to place a sell order. The current exchange rate of a forex pair is always based on market forces.

This will change on a second-by-second basis. As we noted earlier, you also need to take the spread into account, so there will always be a slight variation in pricing. For instance, if you exchange 1 USD for 17 ZAR, the sale and purchase price offered by your forex broker will be either side of that figure. The currency pairs with the most notable supply and demand attached to them will be considered the most liquid in the forex market. The supply and demand aspect is thanks to the investment of importers, trading channels forex pdf, exporters, banks and traders — to name a few.

The most liquid currency pairs are therefore the ones in high demand. When you feel you are ready to take the plunge and begin live trading, you need to select a forex trading system.

There is a vast amount of trading strategies for you to pick from. This is because investors, speculators, corporations and banks have been trading for decades, trading channels forex pdf. In this part of the forex trading PDF, we are going to explain a few of the strategies available to you. If you want to buy and sell currency pairs from the comfort of your home or even trading channels forex pdf your mobile deviceyou will need to use a trading platform.

Otherwise referred to as a forex broker, there are literally hundreds of trading platforms active in the online space. This makes it extremely difficult to know which broker to sign up with. In the below sections of our forex trading PDF, we explain some of the considerations that you need to make. You should also look out for analysis tools available to you, trading channels forex pdf.

In some cases, this might be embedded, while some offer tools such as technical analysis and fundamental analysis. This is because it will save you a lot of leg work having to move between different sites and sources of information.

Some of the fastest and easiest trading platforms are MetaTrader 5 MT5 and MetaTrader 4 MT4. Crucially, both MT4 and MT5 are fast and receptive trading platforms, both providing live market data and access to sophisticated charts, trading channels forex pdf. It is essential before you begin trading seriously that you fully trust the trading platform you intend on using. This is trading channels forex pdf the case if you intend on using a scalping strategy, for example.

However, if you like to trade, it is vital for your peace of mind and your finances that you are fully confident with the fast execution of data transfer. This is also the case with the precision of quoted prices, and the speed of order processing.

All of these things are going to help you to have a successful forex trading experience. To enable you to make the most of new opportunities, the ideal forex broker will be available to you 24 hours a day and 7 days a week, in trading channels forex pdf with the forex market opening hours. To save you from having to request that your broker takes action for you, your forex broker should enable you to manage your account and your trades separately. By doing this, you will be in a much better position to quickly react to any shifts in the market, and hopefully, make the most of potential opportunities.

This will enable you to gain better control over any open positions as and when they arise.

Trading Trendlines \u0026 Channels In Forex \u0026 Stock Market (Price Action Strategies)

, time: 11:31Channel Trading Strategy Guide - Forex Channel Trading System

Discover 91 essential Forex and share trading books, including fundamental and technical analysis books. Download a large selection of PDFs for free, or compare Forex and CFD brokers in one place 30/04/ · Channel trading can be a great way to find support and resistance areas and potential breakout trades. When channel trading, we are trading a channel as it forms and bounces or breaks through the previous channels levels. In this post, we discuss exactly what channel trading is and the best strategies to use it. NOTE: You can get your free channel trading strategies PDF blogger.comted Reading Time: 4 mins 29/04/ · Live London Forex Trading Session, The money making channel. How to Open a TD Ameritrade Account (Step by Step for Beginners) $30 Welcome Bonus RoboForex, Profit is fully Withdrawable

No comments:

Post a Comment